tucson sales tax calculator

The minimum is 56. Tucson is in the following zip codes.

Property Tax Calculator Casaplorer

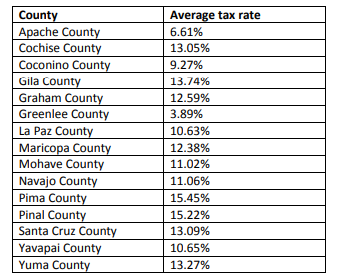

Greenlee County 61 percent.

. You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Avalara provides supported pre-built integration.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tucson Arizona. The December 2020 total local sales tax rate was also 8700. The default sales tax rates are provided for your convienience.

Maricopa County 63 percent. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Name A - Z Sponsored Links.

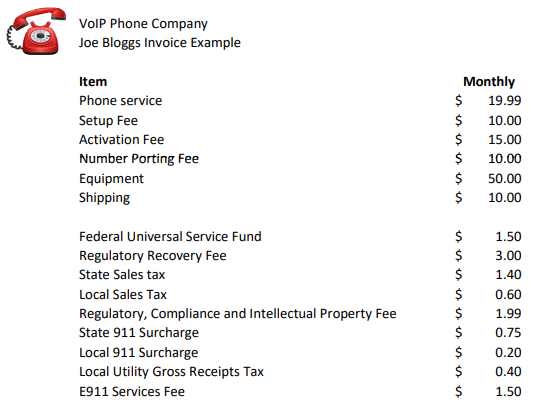

Download all Arizona sales tax rates by zip code The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. Americas Tax Office of Arizona. The December 2020 total local sales tax rate was also 11100.

When combined with the state rate each county holds the following total sales tax. Sales Tax Breakdown Tucson Details Tucson AZ is in Pima County. How to Calculate Sales Tax.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Tucson Sales Tax Rates for 2022. 85701 85702 85703.

Apache County 61 percent. Sales tax in Tucson Arizona is currently 86. You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code.

The sales tax jurisdiction name is Arizona which may refer to a local government division. There is no applicable special tax. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3.

The Arizona sales tax rate is currently. Tucson Code Section 19-1301 is repealed effective January 01 2015. As of 2020 the current county sales tax rates range from 025 to 2.

Multiply the price of your item or service by the tax rate. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

The Tucson sales tax rate is. For example imagine you are purchasing a vehicle. Find list price and tax percentage.

The most populous location in Pima County Arizona is Tucson. Did South Dakota v. Wayfair Inc affect Arizona.

Cochise County 61 percent. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Ordinance 11904 was passed by the Mayor and Council on May 25 2022 amending the City Tax Code by extending the additional five-tenths of one percent 05 tax rate increase on certain business classifications for an additional ten-year period through June 30 2032.

The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Tax Paid Out of State.

The minimum combined 2022 sales tax rate for Tucson Arizona is. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate South Tucson sales tax in 2021. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list.

Pinal County 72 percent. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 11050 S Nogales Hwy.

The current total local sales tax rate in South Tucson AZ is 11100. The average cumulative sales tax rate between all of them is 768. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax Comparison Calculator for 202223.

Sales Tax Breakdown South Tucson Details South Tucson AZ is in Pima County. Sales Tax Calculator in Tucson AZ. Multiply the vehicle price after trade-in andor incentives by the sales tax fee.

Az Sales Tax - Prime Contracting - Class 015. 21120 for a 20000 purchase. Divide tax percentage by 100 to get tax rate as a decimal.

Gila County 66 percent. As far as other cities towns and locations go the place with the highest sales tax rate is Rillito and the place with the lowest sales tax rate is Ajo. Tucson AZ Sales Tax Rate The current total local sales tax rate in Tucson AZ is 8700.

The most populous zip code in Pima County Arizona is 85705. Tax Return Preparation Tax Return Preparation-Business. This is an Arizona sales tax calculator designed to meet the specific needs of the construction industry.

The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson. Price of Accessories Additions Trade-In Value. The County sales tax rate is.

This is the total of state county and city sales tax rates. The 2018 United States Supreme Court decision in South Dakota v. 111 sales tax in Pima County.

You can print a. Tax rates can be. These rates were entered mostly from tables published by the ADOR that were effective as of August 1 2015.

The South Tucson Sales Tax is collected by the merchant on all qualifying sales made within South Tucson. Then use this number in the multiplication process. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

YEARS IN BUSINESS 520 240-7970. How to use South Tucson Sales Tax Calculator.

Locating And Discovering Sales Tax Medical Icon Sales Tax Medical

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Do This To Save 16 On Every Marijuana Purchase In Arizona

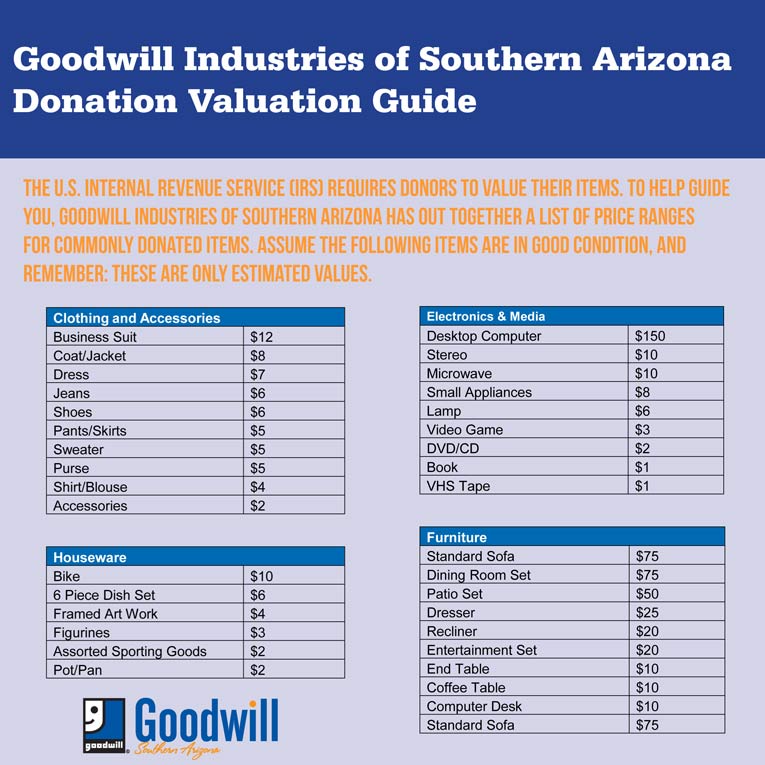

Estimate The Value Of Your Donation Goodwill Industries Of Southern Arizona

How To Calculate Sales Tax For Your Online Store

Property Taxes In Arizona Lexology

Arizona Income Tax Calculator Smartasset

Arizona Sales Tax Rates By City County 2022

How To Charge Sales Tax Vat With Samcart Samcart

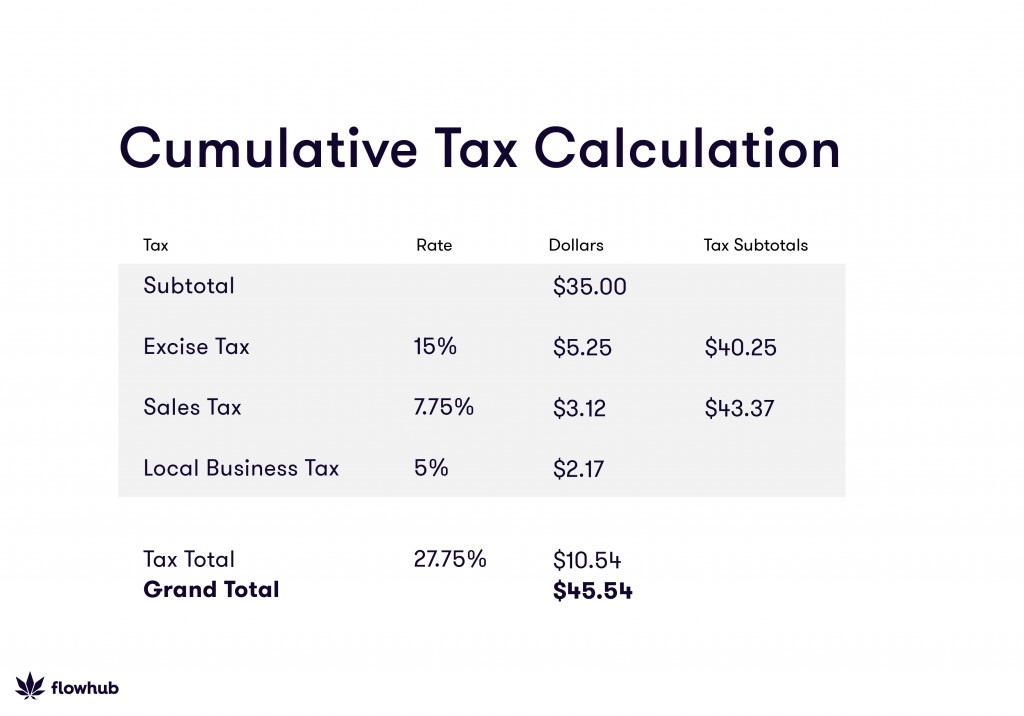

How To Calculate Cannabis Taxes At Your Dispensary

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

A Complete Guide On Car Sales Tax By State Shift

Rate And Code Updates Arizona Department Of Revenue

Illinois Car Sales Tax Countryside Autobarn Volkswagen

How To Calculate Sales Tax For Your Online Store

2020 Hyundai Tucson Monthly Car Payment Calculator U S News World Report

Property Tax Calculator Casaplorer