massachusetts estate tax rates table

Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. The tax rate is progressive with a maximum rate of 16 percent1 Furthermore.

Irs Announces Higher Estate And Gift Tax Limits For 2020

The estate tax due is 20500.

. Your estate will only attract the 0 tax rate if. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. A state excise tax.

Oregons exemption is only 1 million for example whereas New Yorks. The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. Tax amount varies by county.

Form M-706 Massachusetts Estate Tax Return must be filed by the executor of every estate when the Massachusetts gross estate of a resident decedent or the Massachusetts gross estate of a non-resident computed as if the decedent had been a resident exceeds that applicable exemption. However the estate tax exemption threshold in Massachusetts is just 1 million. Settlement Tax Rate Table.

The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes. 73 rows The formula to calculate Massachusetts Property Taxes is Assessed Value x Property Tax. Click table headers to sort.

From Fisher Investments 40 years managing money and helping thousands of families. That amount multiplied by the marginal rate of 128 is 20480. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year. The rate ranges from 8 to 16. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

104 of home value. However the Massachusetts estate tax threshold is considerably lower. Each state sets its own exemption amount and tax rates and determines which assets can escape the state estate tax.

Town Residential Tax Mill Rate Commercial Tax Mill Rate. Up to 100 - annual filing. 10 of income over 0.

In this example 400000 is in excess of 1040000 1440000 less 1040000. All Major Categories Covered. Select Popular Legal Forms Packages of Any Category.

Massachusetts does levy an estate tax. The credit on 400000 is 25600 400000 064. A properly crafted estate plan may.

2000 see table on following page. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. A guide to estate taxes Mass Department of Revenue The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000.

If your taxable estate including any taxable gifts made during your lifetime totals 1 million or more your estate must file a Massachusetts estate tax return and you may owe Massachusetts estate tax. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the exemption threshold.

In many cases the capital gain tax rates are higher than the estate. This is no different from most other New England states like New Hampshire Vermont. 18 rows Tax year 2022 Withholding.

Massachusetts has one of the highest average property. The rate ranges from 8 to 16. Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts Estate Tax Return.

December 31 2000 see Massachusetts Estate Tax Return Form M-706. If a person is subject to both the Federal and State tax then their marginal estate tax rate could be 45 or more. When we add that number 20480 to the base taxes 522800 we get a total Massachusetts estate tax of 543280 owed on a 62 million estate.

The graduated tax rates are capped at 16. The estate tax rate is based on the value of the decedents entire taxable estate. Massachusetts estate taxes Massachusetts has an estate tax on estates over 1 million.

The maximum credit for state death taxes is 64400 38800 plus 25600. However for most individuals who have assets between 1M and 5M then the tax rate hovers anywhere from 0 to 20. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states.

Massachusetts Estate Tax Massachusetts decoupled its estate tax laws from the federal law effective January 1 2003. 2022 Massachusetts Property Tax Rates. 1050000 - 60000 990000.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. In this example 400000 is in excess of 1040000 1440000 less 1040000. Up to 25 cash back If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you would not be taxed more than 16.

It is assessed on estates valued at more than 1 million. The bottom of the threshold is 6040 million so we subtract that from 62 million and get 160000. The top estate tax rate is.

2022 Property Tax Rates for Massachusetts Towns. The federal estate tax by comparison maxes out at 40 percent. Massachusetts Estate Tax Rate Table.

Massachusetts property real estate taxes are calculated by multiplying the propertys value by the locations real estate tax.

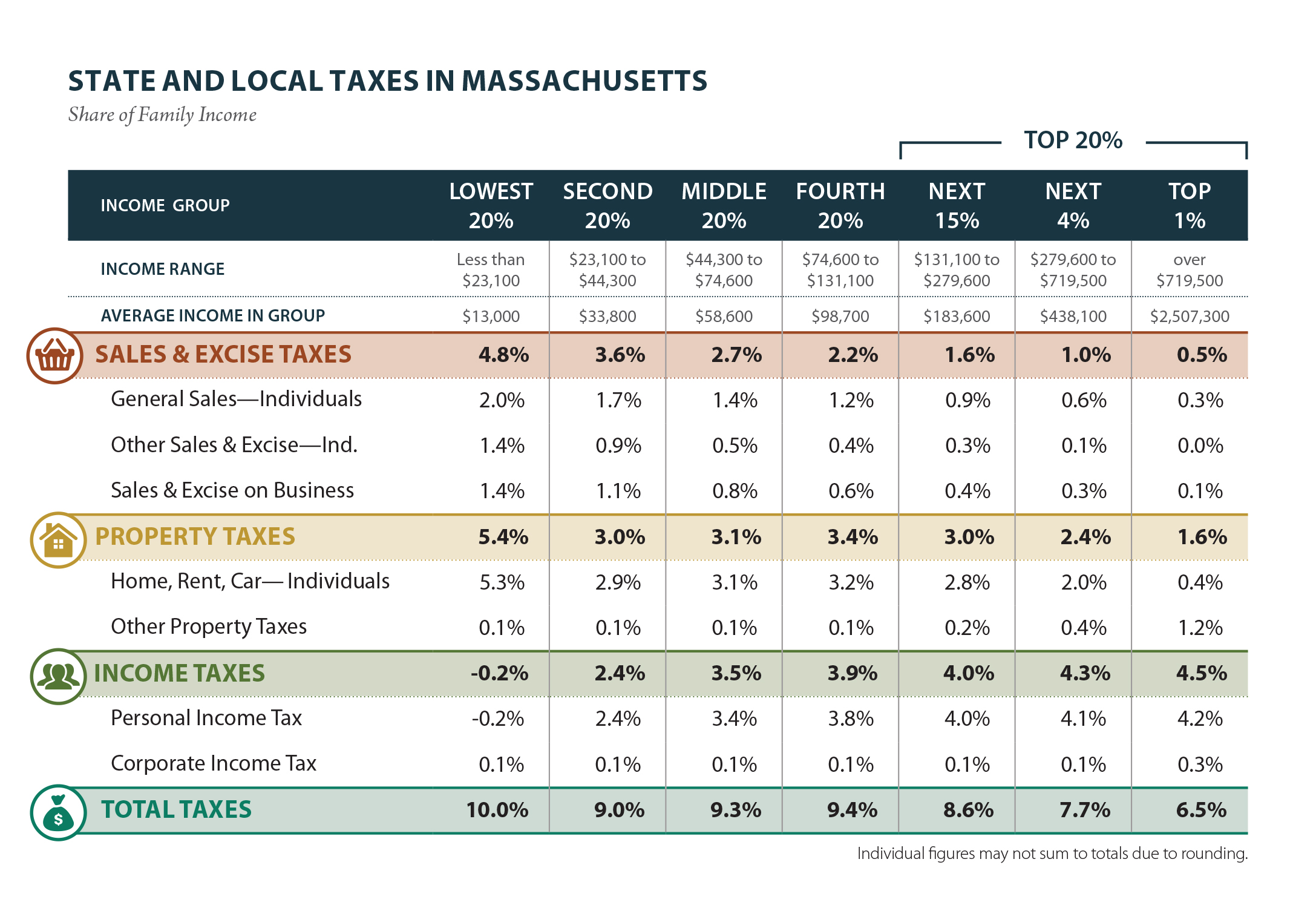

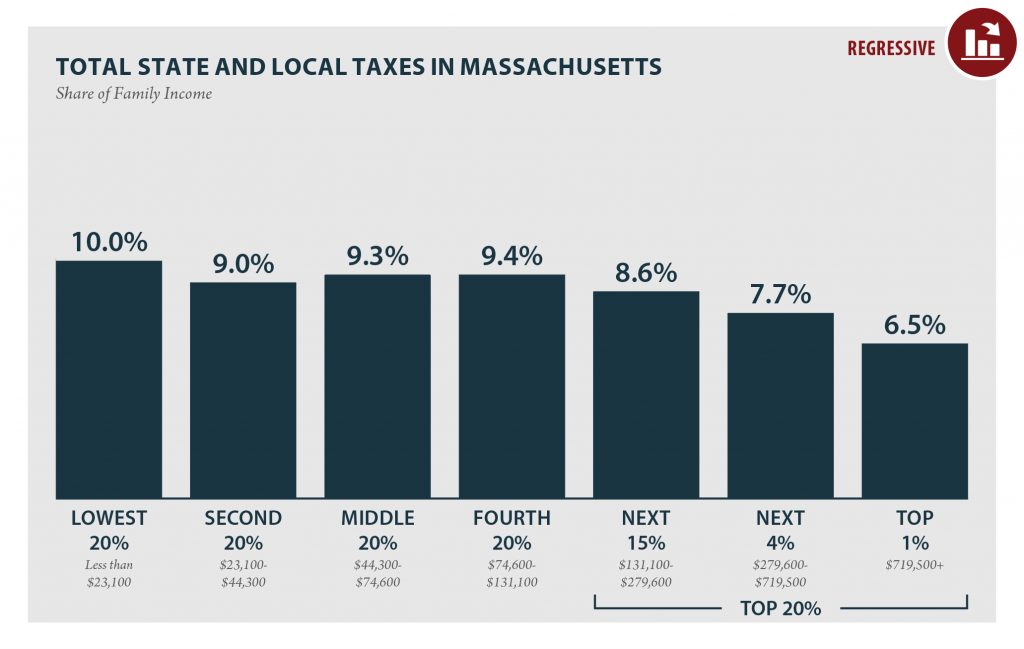

Massachusetts Who Pays 6th Edition Itep

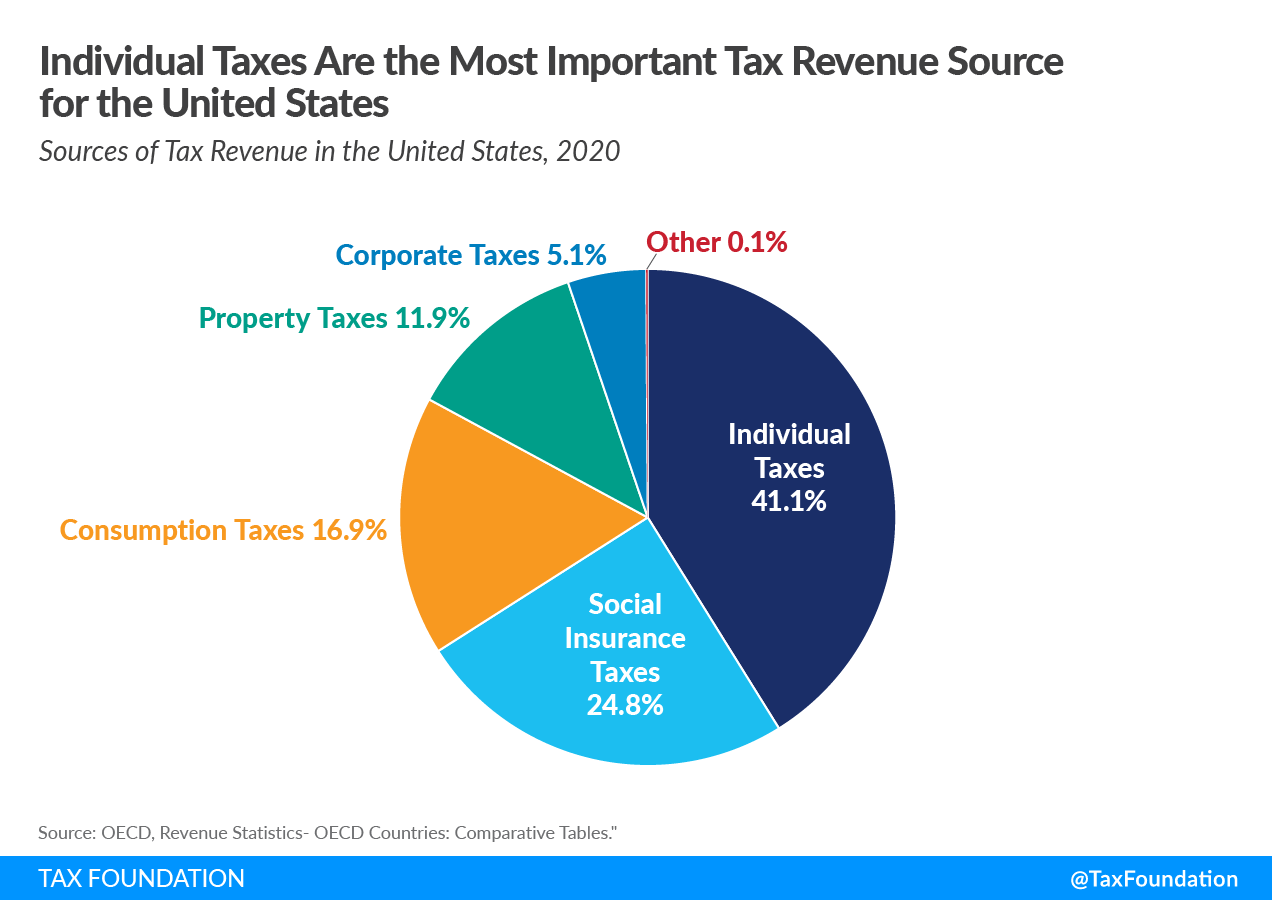

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

A Guide To Estate Taxes Mass Gov

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Massachusetts State 2022 Taxes Forbes Advisor

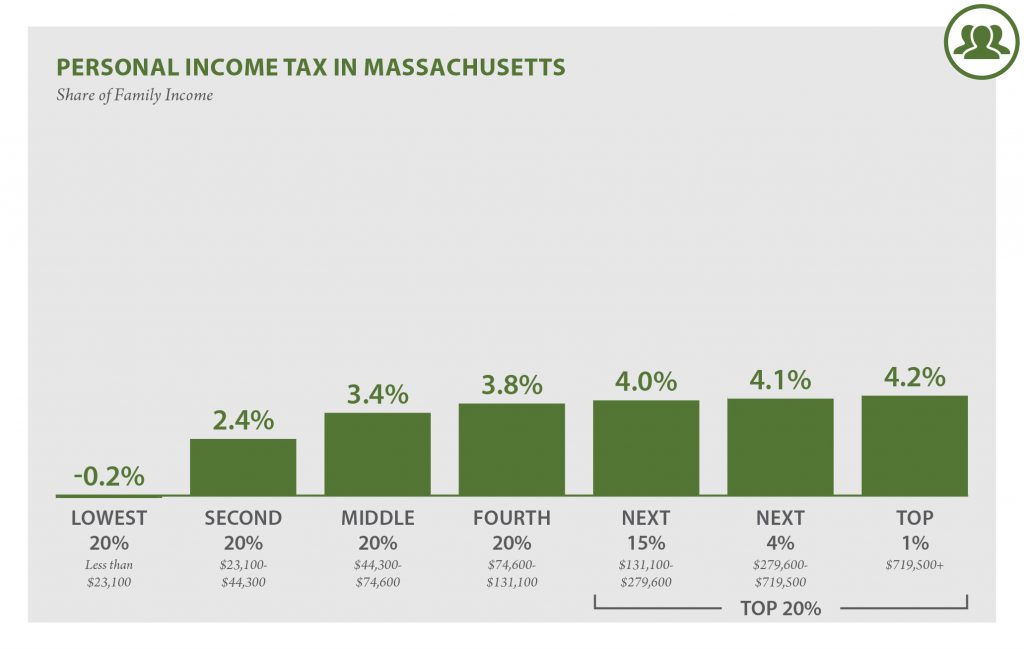

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts Estate And Gift Taxes Explained Wealth Management

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State And Local Corporate Income Taxes Work Tax Policy Center

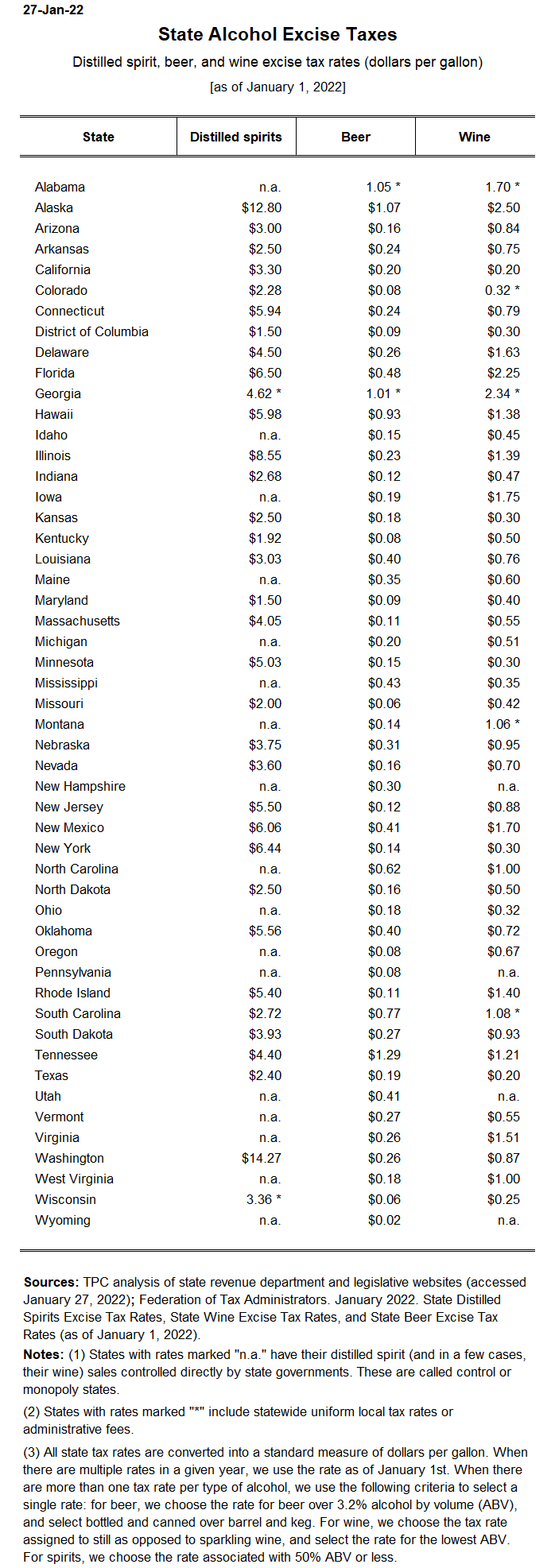

State Alcohol Excise Tax Rates Tax Policy Center

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

2022 Tax Inflation Adjustments Released By Irs

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada